The much-discussed EU Payment Service Directive 2 (PSD2) has been in force since January 2018 in Germany and it sets new rules for data management. The relationship between banks and customers has fundamentally changed; not the least because the opening up of competition resulting from the new regulation means that other players, such as financial start-ups and other service providers, are on the agenda now. For customers, for example, this is associated with greater flexibility and greater transparency in online shopping, while for banking institutions it means a profound transformation of their previous standards. In order to successfully meet this challenge, financial institutions should focus on innovative business models and strategies, such as Open Banking.

With PSD2, the Second EU Directive on Payment Services, banks lose their monopoly on their own customer and account data. If the customer so wishes, the bank must make the relevant internal information available to third-party providers, such as FinTechs. According to a study by the management consulting firm Roland Berger in 2017, this involves up to about one billion current accounts of European banks. To meet this requirement, traditional financial institutions must act now and invest in digital technologies. On one hand, to comply with the regulatory provisions, on the other hand, especially in the case of private customers, to avoid being overcome by the new so-called payment service providers and the products of third-party services.

But what specifically changes for financial institutions and how do they succeed in facing up to these challenges?

PSD2 – The Roles Shift

Brussels wants PSD2 to make access to payments and accounts safer and more convenient for consumers, boost competition and, significantly, promote innovation. So, the directive requires banks to provide free interfaces for exchanging data with external providers. These Application Programming Interfaces (APIs) allow third-party services (such as PayPal or Google Pay, but also start-ups such as savedroid, Scalable Capital or RatePAY) to access information about accounts, transactions and payments without any individual contractual agreements with the bank. The customers themselves grant permission to access their data. For example, new payment and financial advisory services or personalized tools may be created based on the information that the bank needs to provide from the customer's account. The course has been set for Open Banking.

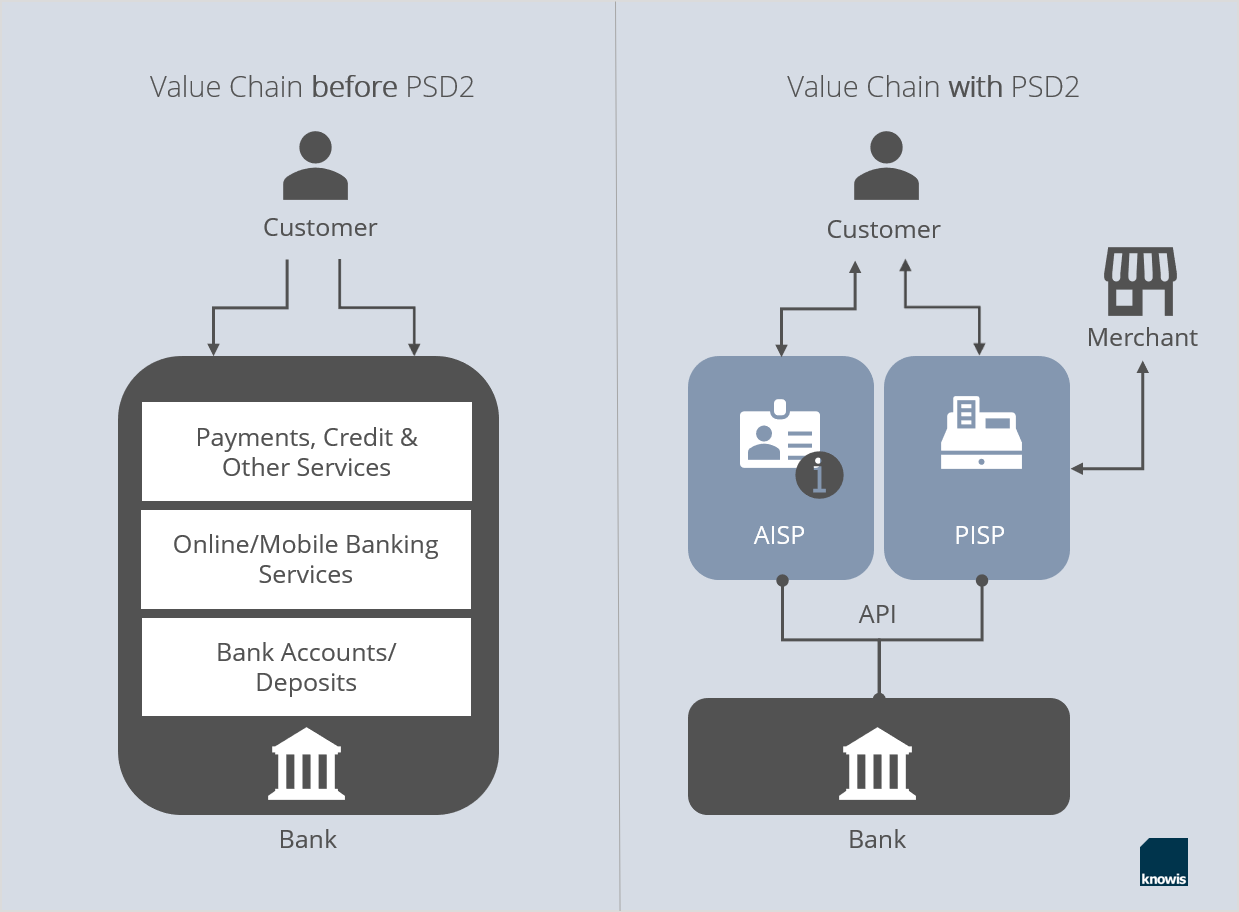

From a technological perspective, this means a change in data management. Rigid, inward-looking data silos are becoming obsolete, and open banking platforms with external interfaces become state-of-the-art as they enable secure third-party access. This results in new roles for the market participants. PSD2 divides the third-party providers into Account Information Service Providers (AISPs) and Payment Initiation Service Providers (PISPs). AISPs automatically retrieve current account information and make it available in real time. PISPs initiate payment orders from account holders without contacting the account-holding institution.

It is particularly impressive to see a shift in the distribution of roles in the market environment for banks in the area of payment services - and the value chain is changing accordingly. The role of the bank as intermediary between customer and retailer in processing payment processes becomes superfluous. Instead, the customer confirms the transaction directly with the purchase using two-factor authentication, the money flows from his account to that of the merchant (Account-to-Account-Payment). For financial institutions, therefore, there is an acute risk of loss of relevance, since they may only serve as an interchangeable backend for the technical and logistical processing of payments.

Loss of Data Sovereignty - Loss of Customer Loyalty

Since third-party services require minimal start-up capital and no banking license, an increasing number of new competitors are already penetrating the market with innovative solutions and payment services. And not just other banks and FinTechs. Even non-financial companies can become new market participants, such as Facebook or Amazon. What this can mean is shown by a small but impressive example from the technology magazine Wired: Assuming that Facebook had the customer's consent to direct access to their bank account and payment structure, in the future, financial transactions could be handled directly via messaging services such as WhatsApp or Facebook Messenger. No bank app or bank details would be needed.

For the customer, this would mean an increase in comfort that they would quickly adopt. Banks are at risk due to these radical changes: they are not only threatened by the loss of control over their data, but also with losing touch with their customers. Now that they're sharing their core business with a plethora of competitors who score with agile and highly customized apps and services, the opportunities for cross-selling in the form of loans, securities, or other financial services are shrinking significantly. This could cost the finance houses up to 40 percent of their profits in the private customer business, according to the experts at Roland Berger.

The Right Mindset for the Digital Marketplace

The compliant implementation of PSD2 requires banks to deal intensively with current technologies. The big question is: how can banks actively capitalize on this additional burden of EU regulation?

Banks need to rethink and realize that implementing PSD2 does not just have to mean effort without consideration; with a different mindset: it enables ecosystems and new value chains. This holds great potential for their business because the bank can become a digital marketplace, for example. In this way, it benefits from the open access to data via the API and becomes an agile digital company that offers its customers tailor-made products or services via its own platform and perfects the customer journey. For example, external providers can be specifically integrated into the offering, or proprietary PISP offerings such as account-to-account transfer or immediate electronic payments can be made available to merchants. So, you profit as a marketplace from both worlds.

Banking-as-a-platform is the keyword: The continuous development of solutions on one’s own platform, which offer the customer real added value, will be an important means of customer loyalty in the future. Interfaces are a decisive factor for successful implementation. In the future, customers will be able to manage different accounts and financial transactions through a single portal, even if the services may be provided by different banks or providers. The question is, who provides this platform. This compact overview of all financial information enables banks to expand their offerings and improve the customer experience. Crucial for the bank is that it manages to create digital services with added value for the customer.

Financial institutions need to reposition themselves within the emerging API ecosystem - not least because partnerships with experienced IT companies are important to plan and successfully execute a strategic realignment as a Digital Bank.

Conclusion

PSD2 is profoundly changing finance. For banks, however, the associated concept of Open Banking is not only a challenge, but also a great opportunity. In order to successfully emerge from the consequences of the EU regulation, the new openness of the data has to be used for their own future strategy. With the realization that a rethinking in this regard can lead to a successful reorientation within the financial market, the first step has been taken. With an agile banking platform as the technological center, new business models and value chains are made possible. The bank as a digital marketplace is a promising option in this regard, which offers added value for both financial institutions and customers.

Image Sources: Teaser: shironosov - 636534262 - iStock; Infographic: knowis AG