The fact that financial institutions are intensifying their efforts to automate their processes and drive their digital transformation is nothing new. However, the current developments resulting from the Corona pandemic have once again revealed how urgently the business departments in banks need end-to-end system support. Complex processes and undisclosed data often obstruct a quick solution. In order to work faster, more efficiently and more cost-effectively and to prepare for the future, financial institutions should rely on next-generation software solutions in which domain expertise is part of the DNA.

Digitization and transformation projects are by no means a new topic in the financial sector. For years now, banks have been replacing paper-based processes with digital solutions and have achieved notable successes with technologies such as robotics and workflow management. When it comes to more complex processes, however, individual technologies often fail to leverage the considerable modernization potential that lies dormant in these areas.

The Financial Industry Needs New Approaches

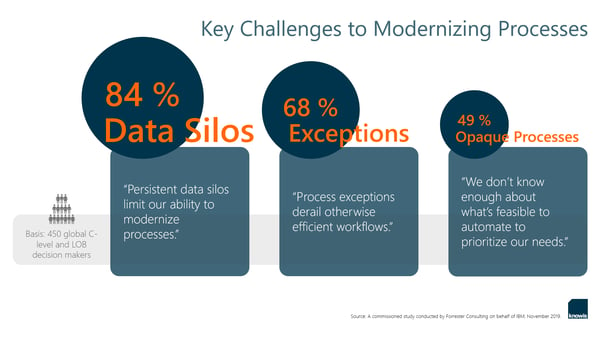

While routine activities have a high potential for automation, robotics and similar technologies reach their limits where more frequent exceptions make expert knowledge indispensable and where the required data for context-sensitive cases remain hidden in closed silos. A study commissioned by IBM and published in January 2020 by Forrester Consulting confirms this: The greatest challenges in process modernization are data silos, exceptions and a lack of insight into processes.

The credit business exemplifies why banks often encounter obstacles when it comes to IT-supported processes. While partial or full automation is comparatively easy to achieve in the case of consumer loans, it is far more complex in the case of corporate loans. There are groups of connected customers and corporate structures instead of just one natural person; creditworthiness is not determined by a single factor, but rather by ratings, scorings and analyses; instead of one product, there are facilities, lines and global frameworks; and a decision is not based on a single authority but requires the involvement of many parties in coordination, voting, escalation and committee situations.

Thinking Beyond Process Automation: The 'Zero Back Office' Challenge

As a result of the complexity in segments such as corporate lending, the experts behind the scenes in particular have to cope with a multitude of heterogeneous tasks. Since the focus of digitization initiatives in recent years has usually been on improving the customer experience, the back office often has no or insufficient software support. How can banks capitalize the potential that is often still hidden there?

- Holistic Process Thinking

In order to address complexity, it is essential to view processes holistically. Only when all dependencies and interrelationships are clearly mapped is it possible to provide system support for the process participants and their collaboration and to make the right information available at the right time in a suitable format. - Data Management

The information collected at the various points should not be stored in isolation or even get lost in the further process, but must be networked in context and made available across processes. Only through networked data organization can cognitive technologies be utilized effectively to unlock knowledge. - Technology Mix

Where a single technology such as robotics does not get ahead, the key is 'hyperautomation' – a multi-tool approach. In addition to business rules management, robotics process automation and data capture, other future-proof technologies such as artificial intelligence or machine learning should be used in combination to automate, simplify, measure and manage workflows and processes.

Next-Generation Banking Solutions Unlock Hidden Potential

Next Generation Banking Solutions are geared to the requirements of the various users for a dedicated use case and support their collaboration. Their ready-made, integrated domain logic allows for a quick implementation, while their modular architecture makes them flexible enough to be further developed and adapted to changing conditions at any time. Future-proof software solutions are scalable, cloud-ready and combine different technologies in reusable services.

Next Generation Banking Solutions are geared to the requirements of the various users for a dedicated use case and support their collaboration. Their ready-made, integrated domain logic allows for a quick implementation, while their modular architecture makes them flexible enough to be further developed and adapted to changing conditions at any time. Future-proof software solutions are scalable, cloud-ready and combine different technologies in reusable services.

As corporate credit experts with many years of experience in the automation of processes in knowledge-intensive fields of application, we at knowis merge banking expertise and technological competence and have a clear vision of the business capability map in this domain. We have shared details of our point of view at various events in the last weeks. If you are interested in how we implement this knowledge into our next generation software solutions and make it consumable for our customers, please do not hesitate to reach out to us. Our experts are looking forward to an exchange of ideas.

Image Sources: Teaser: Rick_Jo - 846181678 - iStock; Info Graphic: knowis AG