When it comes to artificial intelligence, do you think of humanoid robots from Hollywood blockbusters trying to take over the world? While such scenarios are likely to remain pure science fiction, the technology is already moving into reality step by step. In view of the steadily growing amounts of data resulting from digitization initiatives, the use of artificial intelligence has great potential – also in the financial industry. Especially in the credit sector, which is often characterized by complex manual processes, the targeted integration of state-of-the-art technologies allows banks to significantly increase their efficiency, improve the customer experience and thus hold their ground in a fiercely competitive market.

Artificial intelligence (AI) is not only a perennial favorite in gloomy futuristic scenarios from movies and literature, but also red-hot in politics and business, as a look at the headlines of news channels and other media reveals. When the term 'AI application' is used, it often refers to an application based on machine learning: a computer program that uses training data to identify patterns and map them in models. As a result, it is able to solve problems that are so complex that it is hard to describe them mathematically.

While invincible chess computers promise few economic benefits, there are a variety of application areas for AI that have already become part of everyday life: software that recognizes what is shown in pictures, chatbots and virtual assistants such as Siri or Alexa, speech recognition, and 'predictive maintenance' to minimize outages in manufacturing plants are just a few examples. The progressive digitization of our entire world provides 'big data' – the fodder for intelligent machines. The computing capacities required to process the immense amount of data are technically no longer a problem and can be accessed as needed thanks to cloud technologies.

Intelligence² – Using AI Cleverly in the Credit Process

However, companies should not blindly adopt a technology just because it is state of the art, but rather think about two basic things first: in which areas do they want to improve, and where can AI help them do that? Only when there are concrete use cases for which a new technology provides clear added value should its implementation be tackled.

Especially around the complex subject of credit, there is a lot of potential for financial institutions to increase their efficiency. Loan application processing is often a time-consuming and manual process, making it difficult for banks to meet their customers' demands for ever-shorter response times. But how exactly can AI applications help to significantly reduce the time to credit decisions?

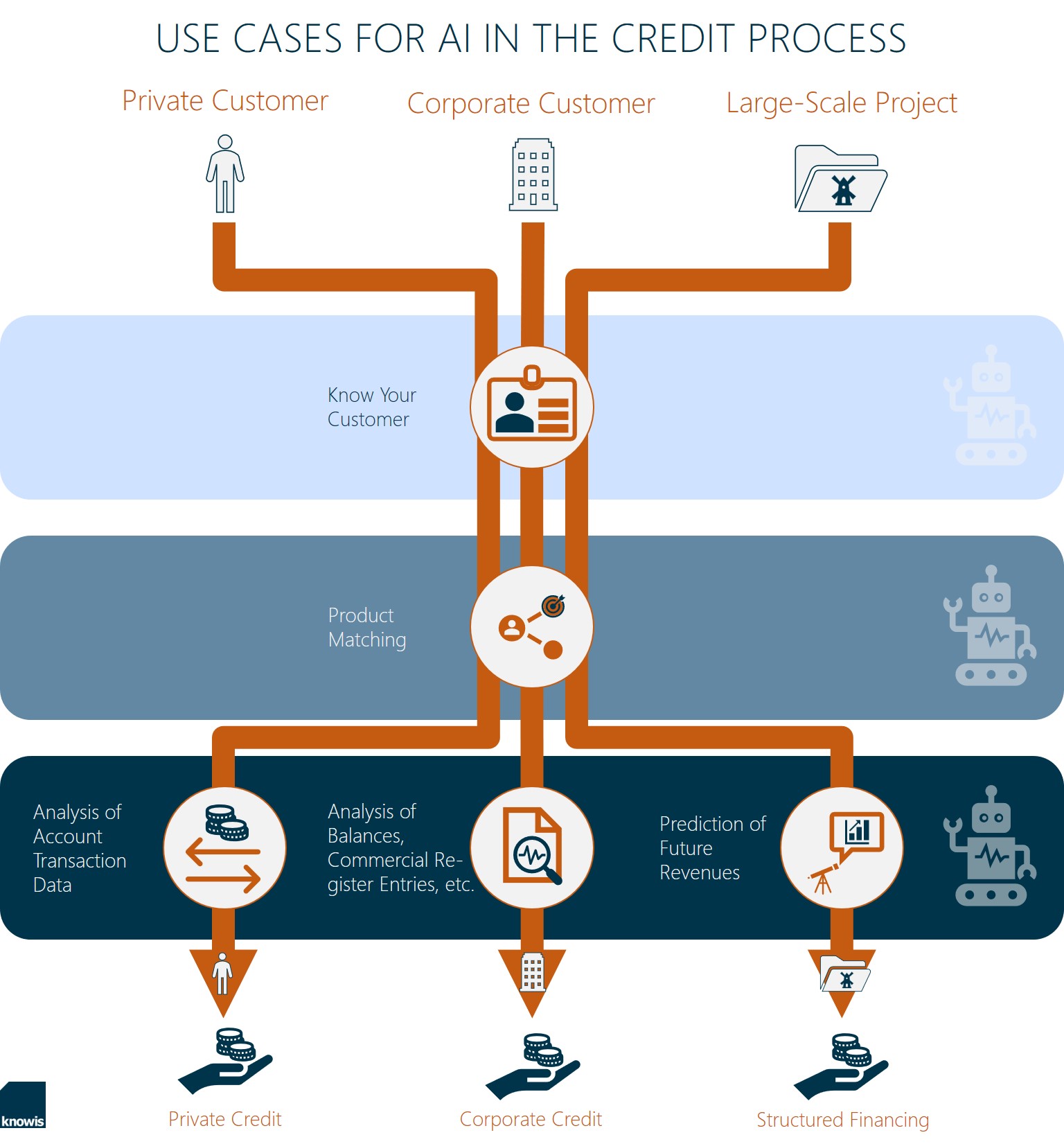

AI can be used in several ways in the credit process to make it more agile and efficient. From legitimizing a new customer who applies for credit, to choosing a suitable credit product or optimizing the credit check – the scope of smart data analytics in the credit sector is wide.

Know Your Customer by Means of AI

Before the actual credit process can start, financial institutions are required to verify the identity of their clients. To prevent money laundering and terrorist financing, banks need to know who they are lending to – 'know your customer' is their instruction. To meet this regulatory requirement, smart applications can be used. These make the identity check as efficient and thorough as possible by automatically checking personal data and business data, such as industry, number of employees, and company structure.

Product Matching – Intelligent Product Selection

Even if the customer is already 'on board', AI can be used before the credit check to improve the customer experience. Customers today expect customized offers that are personally relevant to them. Account transaction data is especially suitable as a basis for a personalized offer, since it reflects actual behavior. If the customer chooses to agree, the bank of their confidence can propose a pre-selection of suitable credit products by incorporating intelligent analysis tools.

The same mechanism can also apply within the application process. When a bank customer applies for credit product A online, their account transaction data must be reviewed to verify their creditworthiness. The integration of AI at this point makes it possible, with the consent of the customer, to insert an additional step and to first check whether another credit product might be more suitable. If this is the case, the alternative product B could automatically be offered. From the customers’ point of view, this has the advantage that they get better conditions; the bank thus increases its chances of lending money.

Credit Check Supplemented by AI

Consumer Loans

When it is clear which product is the right one, the creditworthiness must ultimately be checked. To this end, the financial institution seeks to make a reliable prediction as to whether the customer can repay the credit. For comparatively simple standard products in the private customer sector, this process can already be implemented automatically, for consumer credits, for example, through an analysis of the account transaction data. Thanks to PSD2, this option to check creditworthiness is no longer exclusively reserved for the local bank. External credit providers can also access the existing transaction history if the customer agrees.

Corporate Credit

However, if you take a look at the corporate customer business, the path to a credit decision is much more complicated. Supplementary documents such as tax assessments, balance sheets or extracts from commercial registers must always be included in the analysis, in addition to the account data – a time-consuming process. AI applications can help to extract and contextualize the relevant information from the respective documents, for example, through optical character recognition and subsequent text analysis.

In straightforward cases, fully automated processing of the credit application, similar to consumer loan processing, could take place: A self-learning algorithm verifies the creditworthiness of the customer and calculates the maximum credit limit. The system automatically forwards special cases to an employee of the bank, who can then focus on these more complex instances. Cumbersome manual preparation is taken care of by smart applications.

Structured Financing

The scenario gets even more complex when it comes to structured financing, for example, when financing is not geared to the borrower but to the investment object. So-called special purpose vehicles (SPVs, also called special purpose entities or SPEs), are often set up for project financing. Since balance sheets or other historical data naturally only play a subordinate role in SPVs, the lending decision is based primarily on the expected future cash flow and the associated ability to service debt.

At this point, the use of AI also promises more reliable predictions and faster processes: computers can process significantly larger amounts of data in a much shorter time and continuously improve their algorithms on this basis. For example, the financing of renewable energy projects such as wind farms or solar plants can be simplified with the help of AI. Through elaborate simulations of weather conditions and the plausibility check of these results with the customer documentation, it is possible for banks to make more reliable estimates of future earnings.

API-Banking Opens Doors for AI

In order to enable the systematic integration of intelligent applications and other technology innovations in the right places, financial institutions must create a consistently digital credit process as a prerequisite. A division into small-scale, independent software components focusing on business expertise according to the principle of Domain-Driven Design (DDD) meets the complexity of the credit sector and provides the necessary flexibility. Open interfaces (APIs) make third-party smart applications and other external services consumable in a targeted context.

In addition, the programming interfaces allow the individual components to share information and data – both among themselves and with legacy applications and existing databases of the financial institution. This is essential, because AI in particular needs a solid data base for fodder. 'Garbage in, garbage out' is particularly appropriate here – for example, a machine learning application can only become as intelligent as data input allows. The interfaces give the smart applications access to a comprehensive data pool. Moreover, the data is contextualized in the domain model and inherently linked; this allows AI models to access pre-structured data for specific cases.

Keep Control

According to a BaFin study from last year, some banks are already using machine learning in test systems. A major challenge for them to use this technology sensibly is to avoid the so-called data bias: High quality of the input data ensures that AI applications do not reproduce or even reinforce past discrimination against particular groups.

In addition to this ethical aspect, financial industry supervision stipulates that the explicability of AI decisions is guaranteed. Model governance is used to create transparent AI systems so that financial institutions always have control over self-learning algorithms. This can be achieved through the use of understandable models such as decision trees or through comprehensible approximations – simplified approximations of complex models, which show the essential factors for a decision of the system. This enables banks to take advantage of machine learning and the like while meeting the regulatory requirements.

In addition to this ethical aspect, financial industry supervision stipulates that the explicability of AI decisions is guaranteed. Model governance is used to create transparent AI systems so that financial institutions always have control over self-learning algorithms. This can be achieved through the use of understandable models such as decision trees or through comprehensible approximations – simplified approximations of complex models, which show the essential factors for a decision of the system. This enables banks to take advantage of machine learning and the like while meeting the regulatory requirements.

Conclusion

For banks, the use of AI opens up new opportunities for significantly increasing their efficiency in the future, shortening processing times and satisfying their customers through smart credit processes. On the way to open banking, they are rapidly approaching the productive use of this promising technology. The prerequisite is that they configure their IT architectures flexibly with modular solution components within a banking platform. As participants in ecosystems where networks are linked via APIs, they are then able to selectively consume AI applications from external third parties without having to develop them in-house.

Image Sources: Teaser: Pinkypills - 510584002 - iStock; Graphic: knowis AG