Creating an enhanced, digital customer experience will be one of the key topics in the banking industry over the next five years – for both private and corporate clients. This is the conclusion of the study entitled '2018 Digital Trends in Financial Services' by Adobe and Econsultancy. Improving the customer experience holds great potential for making a positive difference within the fierce competition. However, consistently focusing on customers is easier said than done for many banks, financial institutions and insurers. Outdated legacy systems, decentralized data silos and self-sufficient online departments often stand in the way of a comprehensive view of the customer. There is a need to take action.

First, let's take a look at the current situation in the financial market. On the one hand, there are more and more industry start-ups, so-called fintechs, which can operate flexibly on the market in specialized sectors and without the burden of structures that have grown over decades. They often tailor their business model to a dedicated business process, fully meeting the needs of their customers. New European regulations, such as PSD2, make it possible for these fintechs, especially in the online sector, to take over banking services without having their own banking licenses. This development is already jeopardizing portions of the existing business models of large banks. On the other hand, there is the customers themselves, whose everyday lives are becoming increasingly digital - both professionally and privately - and who increasingly expect online support for their financial concerns, even beyond the simple transfer.

Expectations of the Customer Journey are Growing

For a long time, financial services providers believed that complex services, in particular, were handled exclusively on a personal level by the customer advisor. But as the GfK study 'Customer Journey Banking' of 2017 (German Language), commissioned on behalf of Google and Postbank, already showed: Even with extensive financial products, such as corporate loans or mortgage lending (which are actually mostly completed by a personal advisor), a large number of customers research, configure and communicate online at first, and then expect a further use of this data by the bank at a later advisor meeting. However, the linking of this information in particular is often the weak point during this process. The customer's information journey in the net, the digital customer journey, often ends abruptly at the bank accountant's desk and everything starts all over again.

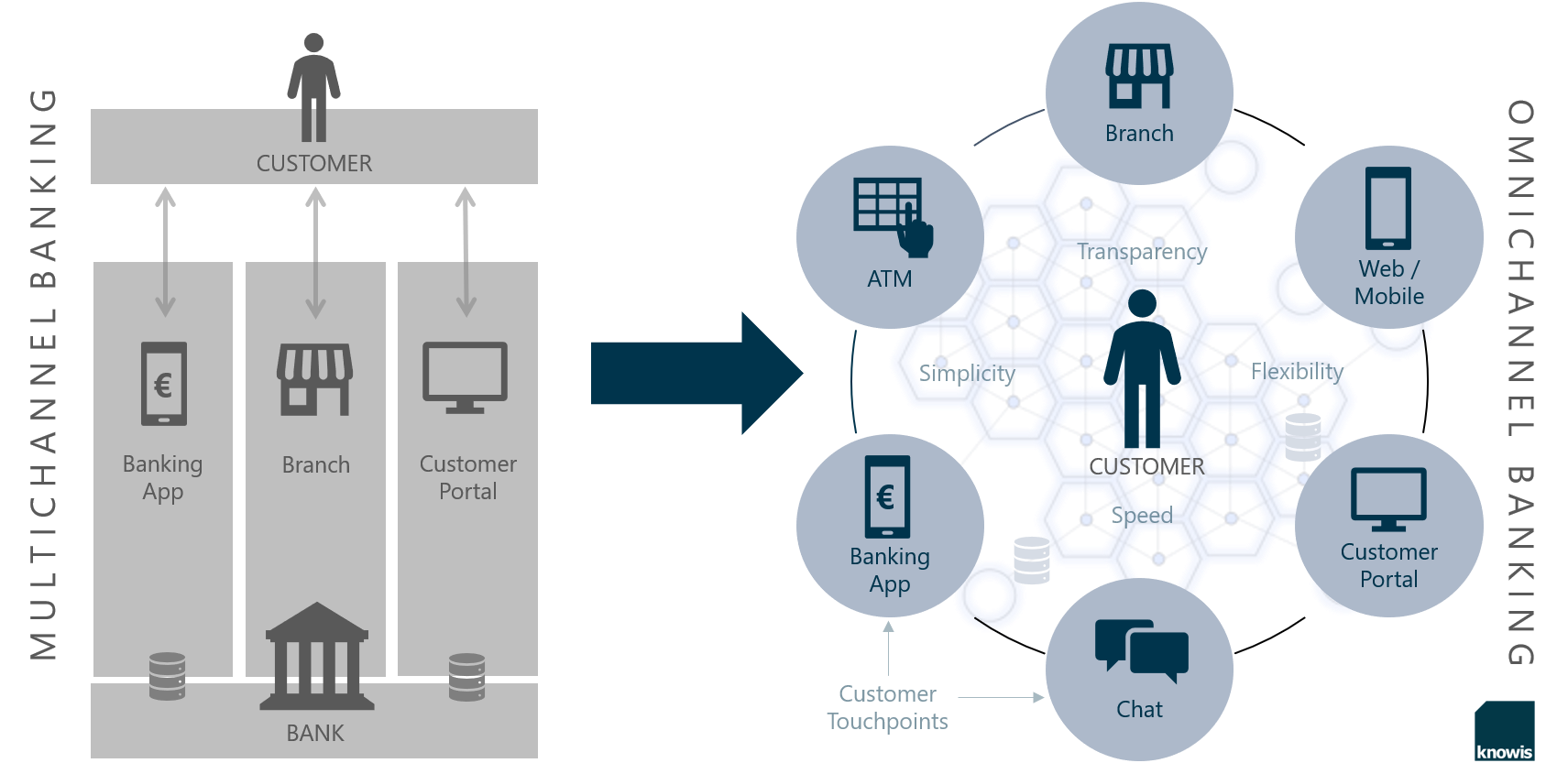

Multichannel Banking is Already an Obsolete Model Today

It would be presumptuous to claim that all financial services providers have ignored the online area. Numerous banks are now using digital and thus online-enabled systems and offer their customers, for example, customer portals, a mobile-optimized version of the website or even a banking app. The topic of multichannel, that is, the provision of offers and services via different media and access points, has arrived in everyday banking.

However, a frequent problem with the current multichannel strategies is that although many of the bank's offerings are gradually made available online, they are designed and operated separately from each other, both technologically and process-wise. Often, completely separate departments are entrusted with the online business, and the systems which are used are not, or only one-sidedly, connected to the core banking systems. The logical consequence is that the resulting information between bank and customer is kept in self-contained databases, lists and legacy systems - depending on the service. A link across the various access points, the so-called customer touchpoints, is usually not given.

According to the study '2018 Digital Trends in Financial Services', more than half of the financial service providers analyzed are currently pursuing a fragmented approach using different technologies and databases within the same company. Under these conditions, it is very costly to provide the customer with relevant and up-to-date information on his or her specific request, considering his or her history.

Omnichannel Banking puts the Customer in the Spotlight

In order to take the next step in the digital transformation, banks need to find a way to bundle data from different sources, and then to structure and link that information. Only through omnichannel banking, that is, based on an infrastructure that allows the bank to access the identical and relevant customer information in all processes via all the channels offered, can real customer-centered models become possible.

The advantages for the customer are obvious:

Transparency

- The customer can view their data at any time and can, if necessary, complete or correct it.

- All the information that has accumulated online or offline can be discussed on-site with the bank advisor.

Simplicity

- The customer has to provide information only once, after which it is available for each transaction.

- Required documents and other attachments can be uploaded from the home PC, identification checks can be done online.

- Informing themselves about new products, customers can use the data of their history and thus obtain a tailor-made offer that considers all factors.

Flexibility

- The customer can use all channels - online and offline, 24/7.

- The opening hours of the branch become less important.

- All information is available, regardless of the channel used.

Speed

- All in all, this leads to significantly shorter throughput and processing times. Consultations with the customer and manual internal coordination processes are minimized.

- Status information updates can be requested in real time or sent via push notification.

However, it is not only the customer who benefits. The bank also saves a considerable amount of administrative work, because now the information which previously had to be researched in advance is available at the push of a button. Consequently, advisors can, for instance, provide information about the processing status of a loan application at any time, without long approval cycles, and thus improve the service. The customer comes back into focus, the employee takes more care of value-adding activities. Alternatively, the customer can autonomously check the status in the online customer portal or automatically receive notifications of a status change, which additionally relieves the bank consultant. This form of customer service is an important tool for enhancing customer loyalty in times of significant competitive pressure.

The Banking Platform as a Technological Basis for Omnichannel Banking

Platform banking is the right way towards omnichannel. The technological basis in this case is an intermediate level, a so-called 'digital agility layer', between the existing systems and the application and customer systems. Thanks to open interfaces, both to all internal systems as well as to the external channels and even the databases of third-party providers, all relevant data can be aggregated and automatically linked on this intermediate level. This creates a holistic database that allows a new, comprehensive view of the customer.

This structured data can then be used as a basis for targeted process automation in a next step. The use of modular solution components enables the gradual transformation of complex business processes without losing sight of the customer.

Conclusion

The portfolios and fee schedules of banks are no longer the sole critical factors deciding which institutions will continue to have an influx of customers in the future, and thus have a long-term existence. Fueled, among other things, by new competitors from the fintech sector, the customer experience is becoming one of the decisive determinants in the increasingly tense financial market.

The portfolios and fee schedules of banks are no longer the sole critical factors deciding which institutions will continue to have an influx of customers in the future, and thus have a long-term existence. Fueled, among other things, by new competitors from the fintech sector, the customer experience is becoming one of the decisive determinants in the increasingly tense financial market.

That is exactly why traditional banks and financial services providers have to catch up on enhancing the digital customer experience – starting at the very base. Because only a database that connects all touchpoints enables modern omnichannel banking and thus a sustainable customer journey that forms a long-term bond between the bank and the customer.

Image Sources: Teaser: djedzura - 542929108 - iStock; Infographic: knowis AG