The financial sector is a very complex area of business, which works with a large amount of information and in which even small discrepancies in the flow of information have far-reaching effects. The costs, risks, and the duration of a digitalization project, therefore, seem difficult to calculate. For this reason, many banks are reluctant to take the step toward the urgently needed transformation into the digital world. Using a practical example of digital banking, we will show you how a credit platform was implemented in just twelve months that has set the course for credit management 4.0 and significantly increased the bank's performance.

Every financial company has its individual strengths and its own grown structures. These must be identified and transferred to the digital world. The biggest challenge lies in the smooth integration of legacy systems, some of which are still based on older technologies and will have to be integrated into the new processes, at least in the medium term. A complete conversion of all business areas in a big bang is often not practical and goal-oriented - the planning time would be too long and the performance of the financial institution too limited during the implementation phase. Experience has shown that the corporate banking business, especially the corporate lending business, has great potential for optimization through digital, automated processes. This division is therefore also predestined for the first step toward digital banking.

In the project outlined below, the corporate lending division was chosen as the starting point for modernization. With a knowledge-based combination of technologies, a cross-divisional credit platform was established which is located above the core banking systems and whose implementation did not require any intervention in the existing systems. The focus was on introducing the digital loan application template, which is used for system-supported loan decisions in the relevant business areas. It electronically maps the entire process from application, analysis, and the decision to archiving.

Involve the right people and build a powerful team

The team entrusted with the implementation is fundamental for a successful project. Around the core team it was, therefore, important to involve the company's stakeholders into the modeling of the processes, both from a banking and technological point of view. Whether they are credit experts, IT department heads, digitization officers, or clerks - all these people know your processes and legacy systems in detail. And perhaps even more important: They also know the weak points of the existing processes. This will temporarily bind more employees to the project, but the effort for coordination and inquiries will be significantly reduced. The fact that people who later work with the system are involved in the planning also increases acceptance and understanding of the system.

Define professional goals and develop the solution configuration

In a first step, a clear target picture for the credit platform was defined together with the department and the possible use cases were analyzed and documented. These use cases were based upon the customer's strategy and the individual performance requirements.

Some examples of the customer’s strategic performance requirements regarding this project:

- Minimize processing and waiting times significantly

- Complete audit security and fraud prevention

- Immediate ability to provide information to customers and colleagues

- Replacement of MS Office programs within the loan decision processes

- Simultaneous working on loan templates of several persons

- Comprehensive process transparency

- Preservation of space for expert knowledge

The overall goal of this project was to automatically move process control into the background, without forcing the user to perform any defined process steps. Nevertheless, full process transparency and control should always be ensured for all parties involved. The actual technical logic is implemented and guaranteed by an intelligent information link on the new credit platform (keyword: comprehensive domain model). The user is then provided at any time with all the information that he needs in the specific task context.

All relevant cases and business processes were continuously extracted from these specifications, translated into technological requirements, and finally, a solution configuration was developed.

Basically important: Technological specifications should never be the focus of attention when designing professionally driven solution ideas. Of course, the requirements of the credit management departments must be harmonized with the functional and process-related capabilities of the IT solution, but the software should always adapt to the processes and not vice versa. Therefore, standard software in the banking sector quickly reaches its limits, since it cannot map the diverse professional requirements in the corporate loan sector out-of-the-box.

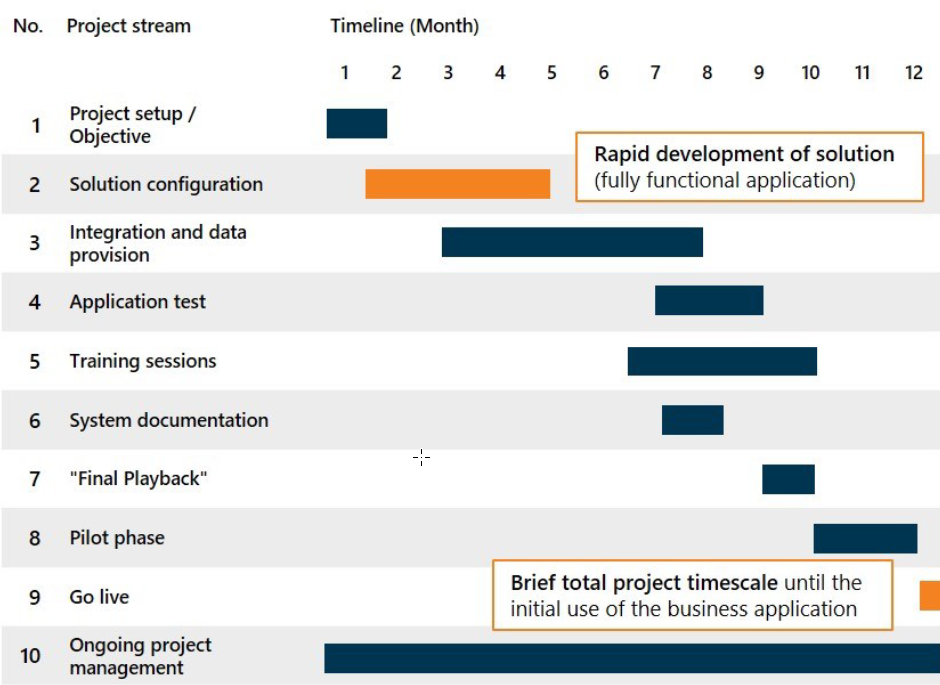

Mainly due to the platform technology, the implementation time for the solution configuration could be kept to a minimum, despite the comprehensive requirements of the customer. In short iterations, the professional requirements were implemented directly on the solution platform and approved by the respective departments.

It took only four months to develop a technical solution, including the creation of a functioning application.

Integration and Testing

The application was integrated into the bank's existing infrastructure via interfaces/web services to the established core banking systems. All systems that provided relevant information for the loan processing were considered. The information was linked on the credit platform using so-called ontology-based domain models.

Due to the iterative development, the basic functional tests of the individual software processes already took place within the corresponding development cycles, whereby the final test effort could be considerably reduced. Complete sub-areas could already be optimized and approved parallel to the integration phase, which also had a positive effect on the duration of the entire project process.

Training, Pilot Stage and Go-Live

Often neglected, the topic of training is one of the central factors in creating acceptance for a new system. Bank employees were professionally familiarized with the new system through a digitization partner. In some cases, employees in key positions were also specifically trained, who subsequently instructed other colleagues and thus acted as multipliers.

However, the aim was to develop an intuitively manageable system through modern web applications that was easy to learn and self-explanatory. Where possible, existing work styles were retained. The focus of the training courses was on the new functions.

After the successfully completed pilot phase, the planned go-live of the first business application was achieved after 12 months.

Conclusion

The step into digitization seems to be a big one in the corporate lending business. Knowledge-intensive processes, often containing exceptions, must be mapped and different existing systems must be connected. However, practical experience shows that a step-by-step system integration, starting in business areas with high automation potential such as corporate lending, is a purposeful approach.

If the right employees are involved right from the start, the coordination effort is considerably reduced. Through iterative decision and development processes during solution configuration, very specific process and performance requirements can also be implemented in short project runtimes. In addition, the test effort before the go-live is considerably reduced. Attention should also always be paid to usability and training, as employee acceptance is an important factor for the success of the project and the subsequent project steps.

Image Sources: Teaser: JCPJR - 77110926 - fotolia.com, Infographic: knowis AG