The increased expansion of renewable energies is a crucial future trend in the energy industry. As part of the energy revolution, extensive structural projects are required that have special characteristics which lead to highly complex and sophisticated financing constructs. However, to capitalize on this source of revenue, banks need to find a way to digitally map that complexity and make it manageable.

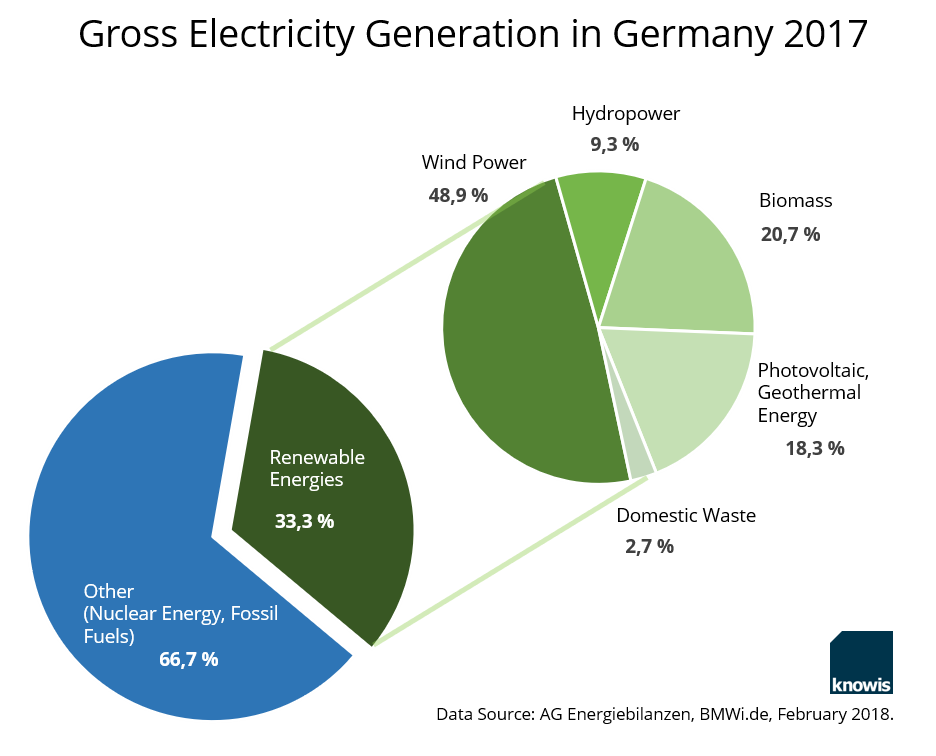

By 2050, the expansion of renewable energies in Germany will continue to progress as part of the energy revolution. By then, environmentally sound energy alternatives are projected to have a huge share of 80 percent of electricity generation. At the moment, there is still a long way to go to achieve this goal; the share of renewable energies in gross electricity generation in 2017 was only around 33 percent.

Lengthy approval processes, unsuitable locations, and frequent changes in government funding to boost competition – these are just some of the challenges of implementing energy projects. These influencing factors affect the way in which projects are designed. Profitability and planning security are becoming increasingly difficult to achieve for smaller projects because of the challenging circumstances.

The trend in the industry is therefore mammoth projects that promise much yield and little resistance from skeptical neighbors: These are mainly huge wind power projects at sea, so-called offshore installations. For example, two new giant offshore wind farms are currently being built in the North Sea. This is the largest offshore project in Germany to date: 87 wind turbines, the annual output of which could supply all private households in Munich.

Looking at these developments from the perspective of the financial world, the following conclusion can be drawn: The energy revolution is a daunting financial feat. In the future too, enormous resources will be needed to be able to carry out the energy revolution. The financing volume per project is expected to increase massively.

Financing needs related to Major Projects in the energy industry

What does the trend towards this type of large-scale projects mean for banks as potential financiers? The answer to this is first of all: special risks. Higher default risk due to huge loan volumes, difficult to calculate implementation periods due to the challenging 'seabed', paradigm shifts in government funding, legal uncertainties due to international participants and contracts, and strict focus on future cash flow are just a few of the cornerstones of the risk profile of these projects. Thus, the financing required also has highly individual requirements and characteristics. Usually, finance works at this point with structured financing. These financing constructs can map the complex structures of such projects and enable differentiating decisions.

Conversely, the combination of special risks with individual requirements means above all one thing: a high audit effort for the financial institutions. Banks not only need to collect the data that they need, but also, they need to effectively leverage, control and understand it. In addition to general information about the project, such as the financing plan and the total purchase price, this includes specific information about the special purpose vehicle (SPV), the wind index region or contracts related to the wind turbines.

Much know-how and personnel are needed to successfully implement projects of this kind. What matters is that banks keep track of complex financings so that they can quickly respond to changes in project finance variables and minimize risks. Why should banks, in times of rising costs and scarce human resources, participate in the implementation of such complex energy projects?

Recognize and use the potential of structured financing

Despite demanding financing needs, investing in the energy industry is worthwhile for banks if the projects can be carried out soundly and efficiently. Particularly in times of low interest rates, where only minimal return from the deposit business can be generated, new business fields in the lending industry are more than interesting. Another advantage: many of the newcomers from the fintech industry do not dare to approach such complex areas. This offers a promising opportunity for banks to profitably position themselves as a reliable financing partner with the necessary know-how.

This can be quite profitable for banks. The increased financing volume of large-scale projects in the field of renewable energies, such as the financing of the huge offshore wind farm Triton Knoll off the British East Coast for an amount equal to 1.94 billion euros, for example, has enormous potential for financial institutions. It entails syndicated financing involving 15 banks, including three German regional banks.

However, from the point of view of job cuts and cost pressures, which many institutions are currently struggling with, digital processes are an absolute prerequisite for fully exploiting this potential.

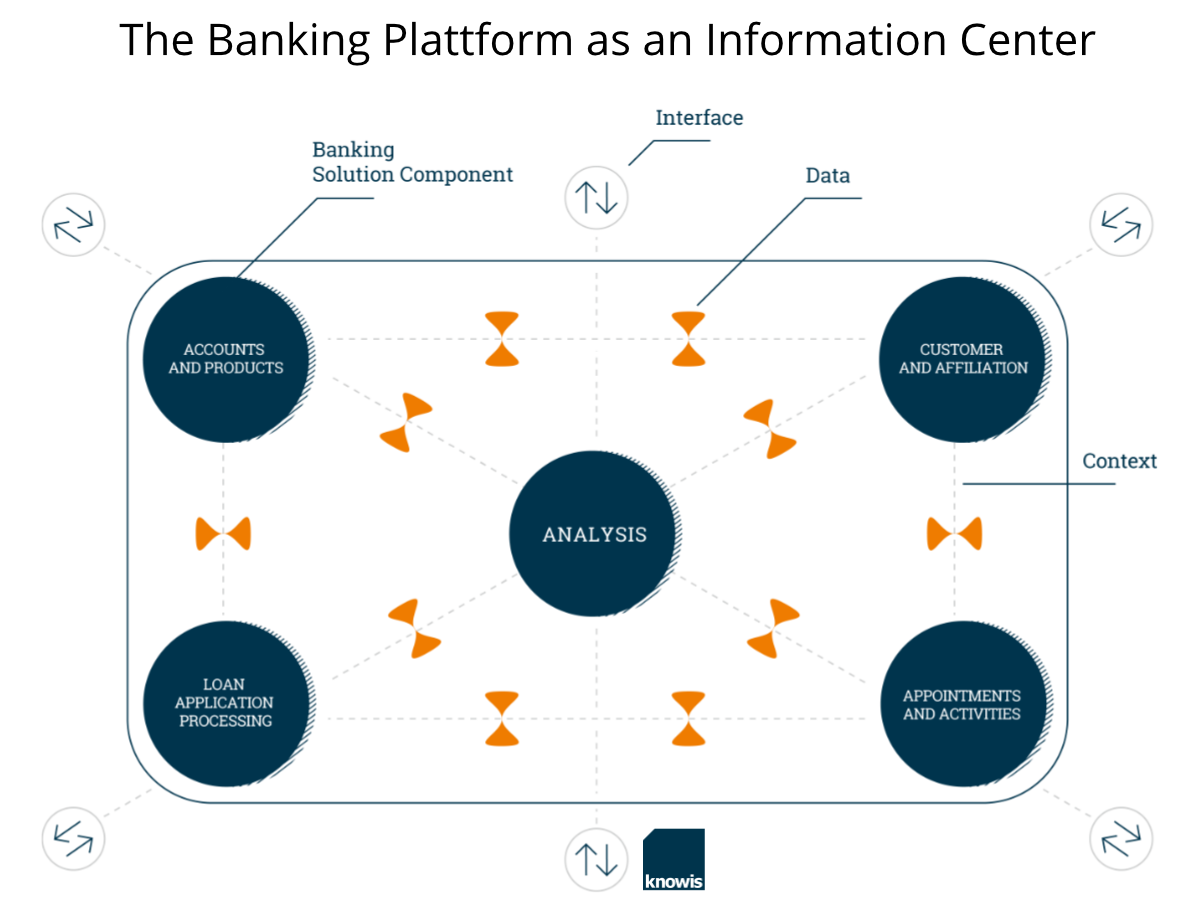

Mastering complexity through modularization

In order to facilitate the digitization of the extensive processes of energy financing, it is helpful to focus on the subject matter. As this expertise in the area of structured finance is extremely complex, standard solutions do not achieve this goal. It is much more effective to break down the whole of these financings into small, manageable components: individual, technically-grouped solution components, such as the modules 'Analysis' or 'Assets'. These components can then be used to manage assets ('Assets') or customer and performance ('Analysis'). These modules can be used individually or interact via interfaces as required.

In this way, even challenging projects can be analyzed purposefully with the help of digitized components with regard to their risks or profitability, and other scenarios can be flexibly analyzed in the event of changes. The more connected components, the greater the added value.

The main advantages at a glance:

- Better understanding of complex issues

- More flexibility in case of procedural or technical changes

- Synergy effects through the information linking of several solution components

A banking platform for linking data

For financial service providers, the information link is essential today to keep pace with changes in the business environment. Customized financing concepts and secure project execution are required if you want to benefit from the changes within the energy industry. Banks therefore need a central hub where data can be networked and all the necessary information about the processing of structured financing can be made available contextually. Optimally, the system has interfaces to also be able to use external data sources. The formation of a complete IT ecosystem is the goal.

An open banking platform is the most appropriate technological approach. Data from bank-internal inventory systems or external channels, such as economic databases, can be easily integrated and managed there. All relevant information is viewed from the perspective of the situation so that it can be optimally utilized. Elaborate searches or unnecessary double entries by the user are avoided. The effective automation of process flows is only possible with this type of data management.

The main advantages at a glance:

- Existing data is automatically linked

- Relevant information is provided contextually

- External data sources can be integrated

Conclusion

By making the vast amounts of data generated by project financing manageable and allowing necessary processes to be handled digitally, sustainable digitization is emerging. Especially in the case of complex financing processes, as they are increasingly occurring within the energy industry, this is enormously beneficial for financial institutions and makes such projects effectively feasible in the first place. By using bank-technical solution components, it is possible to create agile financial solutions tailored to the project and its automated processing.

Financial institutions are structuring and consulting specialists and they not only assist energy giants as an investor, but above all, they serve as a reliable partner. At the same time, banks can profitably exploit the potential of such demanding projects in the context of the energy revolution, of which there will certainly be many more in the future.

Image Sources: Teaser: PPAMPicture - 858990242 - iStock; Infographics: knowis AG